American Airline’s Weak Position in New York City

Overview

Throughout the years, American Airlines allowed its presence in the New York City area to dwindle as Delta and United rose to the top. As America’s largest metro area with three slot-constrained airports (JFK, LGA, EWR) and three regional airports (HPN, ISP, SWF), the New York City area is fiercely competitive for the airlines that serve it. In 2003, American was the second-largest airline in New York, flying 17% of passengers, and 20 years later it is the fourth-largest with just a 12% share despite significant industry consolidation. Looking at American’s schedule for August 13, 2024, the airline has 260 departures across four airports: LGA (128), JFK (96), EWR (24), and HPN (12). For reference, Delta and United each have over 500 daily flights departing from the area’s airports.

While American did have to let go of some slots through the merger with US Airways in 2013, they have not put much of a focus on the market after the merger, even, almost laughably, forgetting they had slots at JFK. Now with the jetBlue Northeast Alliance entirely dissolved, American is in a weak position in New York with significant gaps in its network likely leaving frequent fliers looking elsewhere for certain flights or altogether.

2003 New York City Area Airline Share %

2023 New York City Area Airline Share %

American NYC Area Statistics

(All data below is from American’s website for 8/13/24 collected 3/1/24)

HPN

Departures: 12

Seats: 780

Destinations: 4 (1 seasonal)

Aircraft: CRJ-700 (12)

LGA

Departures: 128

Seats: 14,046

Destinations: 50 (5 seasonal/non-daily)

Aircraft: E175 (60), 737-800 (32), A319 (17), E170 (14), 737-8 (3), A321 (2)

JFK

Departures: 96

Seats: 13,754

Destinations: 44 (4 seasonal/non-daily)

Aircraft: E175 (34), A321 (16), 737-800 (13), 737-8 (13), 777-200 (10), 777-300 (5), A319 (5)

EWR

Departures: 24

Seats: 4,284

Destinations: 5

Aircraft: 737-800 (13), A321 (6), 737-8 (3), A321N (2)

Total

Departures: 260

Seats: 32,864

Destinations: 79 (9 seasonal/non-daily)

Aircraft: E175 (94), 737-800 (58), A321 (24), A319 (22), 737-8 (19), CRJ-700 (12), E170 (14), 777-200 (10), 777-300 (5), A321N (2)

Major Gaps in American’s NYC Network

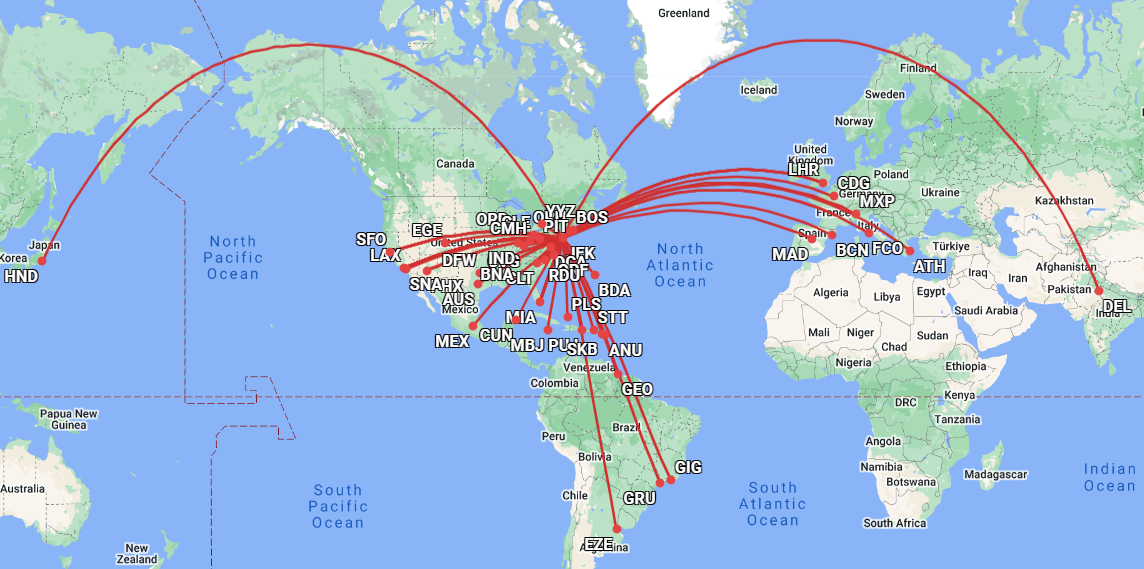

The New York City market is fragmented. Three major airports with limited slots and three minor airports make it difficult for airlines to have one major hub. United comes the closest with their presence at Newark Liberty (EWR) while Delta and American operate hubs out of both LaGuardia (LGA) and JFK. For frequent flyers in New York City, American’s network is limited with significant direct service gaps to major markets served by, in many cases, all of their competitors. Why is this? New York airports are notoriously expensive and sometimes unprofitable to operate out of pushing American to shift its focus to more profitable hubs like Dallas/ Fort Worth (DFW), Charlotte Douglas (CLT), and Miami International (MIA). Additionally, American smartly filled many gaps with the Northeast Alliance with jetBlue, but now officially over, AAdvantage members are lacking direct flights to markets which Delta, United, and jetBlue serve.

American’s strategy is unique in the industry. They are seeking profit from smaller markets with fewer options, rather than larger markets with more valuable frequent flyers. Without basic direct service to major markets American will continue to bleed high value frequent flyers in New York City. Below are major gaps in their NYC network and potential future fixes if they choose to address the gaps left by the failed Northeast Alliance.

OneWorld and Codeshares

American and the other major US carriers each have several partners which their customers can earn and redeem miles through. In 2023, American’s partners accounted for roughly 5% of passenger traffic in the NYC area while United’s flew 6%, Delta 5%, and jetBlue 3% (data from BTS and Port Authority NY NJ). Some airlines have partnerships with more than one of these carriers such as Hawaiian.

With partners included, American still sits at #4 in the New York Area, even offering fewer seats than jetBlue despite them not being part of a major Alliance. However, American’s partners do make a decent difference for AAdvantage members as Alaska Airlines and British Airways together account for close to 3% of the region’s traffic. These are two key partners as Alaska provides service to major cities on the West Coast filling gaps in American’s network to SAN, PDX, and SEA, while British Airways offers substantial service to London (LHR and LGW) with connections throughout Europe. Other top parters for American are Aer Lingus, Iberia, JAL, Qatar, and Cathay Pacific, most of which are OneWorld members

American’s Future in NYC

While American will likely continue their strategy of focusing on more profitable mega hubs and smaller markets with less competition, it is interesting to think through what it would take to optimize their current network in NYC or potentially push for a strategy to become more competitive with United and Delta. Yes, this is difficult and expensive in slot constrained New York and change usually requires mergers or major industry shifts, but below are some steps outlining what a change in strategy could look like.

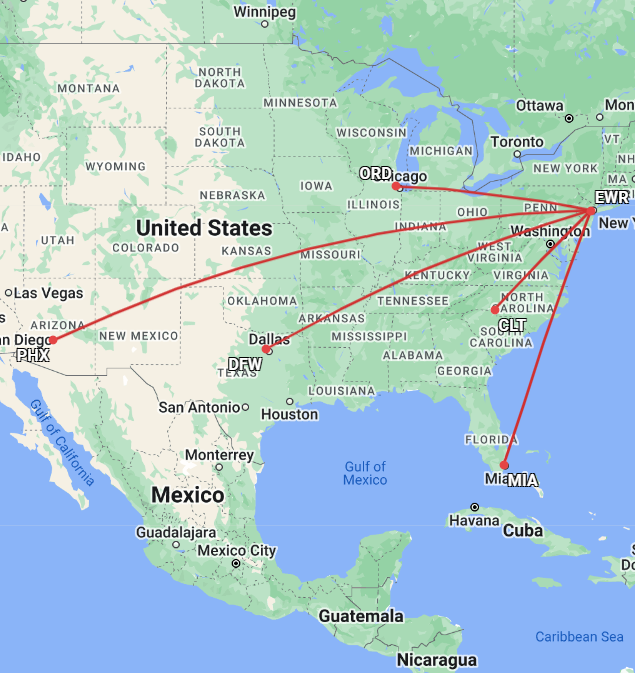

The first step to create a better market for lucrative frequent flyers would be to fill gaps left from the jetBlue Northeast Alliance. American did some minor tweaks to their network, like reinstating service to Boston (BOS) and Philadelphia (PHL), but there are still large gaps domestically. Key markets not served by American from NYC are on the map below.

Direct service to these markets would make it more appealing for frequent flyers to choose American as United, Delta, and jetBlue all offer direct service to these destinations.

Light service, 1-2 departures per day, could be achieved with slight shifts in the current schedule. Upguaging to larger equipment on certain routes and pulling one flight from other frequently served destinations could go a long way in opening up slots. For example, if American chose to fly A321s to DFW rather than 737-800s they could maintain the same seat capacity with fewer flights. This is grossly oversimplifying, but airlines do have tools at their disposal to make such shifts.

Beyond these destinations, it would be a long calculated strategy to increase American’s share in NYC through increasing their network density and adding thinner routes.

Conclusion

While nothing is certain, it is likely American reinstates service to more destinations left from the Northeast Alliance, especially bigger cities in Florida and Atlanta. Competition is strong on these routes, but frequent flyers should expect direct service on their airline of choice from NYC. Is it in American’s best interest to double down on its meg hub and smaller market strategy? Or are they risking a lot by bleeding lucrative frequent flyers in America’s largest metro area? Contact us and let us know what you think!